The Mediating Role of Credit Card Misuse on Collegiate Compulsive Buying:

A Replication Study

Cynthia Dublin

Chang-Ok Choi*

G. Kevin Randall*

Bradley University

Key Words: Compulsive buying, credit card misuse, college students.

Abstract

The average age at onset of compulsive buying is 18-24 years. This study replicates Palan, Morrow, Trapp, and Blackburn (2011) who investigated credit card misuse as a mediator between self-esteem, power prestige, and risk taking for compulsive buying behavior in undergraduate business majors. In addition to including all majors at Bradley and both sexes, we controlled for personality, a known covariate for credit card misuse and compulsive buying.

After IRB approval, a convenience sample of 200 Bradley students, representing each of the five colleges, filled out a 41-item questionnaire assessing demographics and the study variables. Based on the mediation model tested by Palan and colleagues, we first correlated all study variables and then tested the model without and with the control variables, gender and personality, using partial correlations and path analysis.

Bivariate, partial correlations were different from the Palan et al. study, although the path model was replicated. For example, self-esteem and credit card misuse were associated (r = -.17, p =.05); however, when we controlled for personality and gender, the relationship was attenuated and non-significant (r = -.12, p = .19). Controlling for personality and gender in the path model completely eliminated the influence of self-esteem.

Including all majors, men, and women differentiated our findings from Palan et al. (2011). The influence of personality and other individual factors on compulsive buying and credit card misuse are discussed. In addition, suggestions for financial education are included.

Introduction

Compulsive buying, an individual's buying behavior which includes irresistible urges, loss of control, and continuation despite harmful consequences (Dittmar, 2004b), is an increasing trend in western societies (Neuner, Raab, & Reisch, 2005). It is estimated that 5 million Americans are affected with compulsive buying behavior (Dittmar, 2002). This is attributed to the strong drive of our consumer culture that encourages materialism and keeping up with "The Jones." However the outcome of compulsive buying may lead to unmanageable levels of debt after years of excessive spending (Christenson et al., 1994). Individuals may become consumed by worry over the level of debt through personal shame and guilt, in return causing strained relationships with family members and friends (Elliot, 1994).

Compulsive buying problems begin during late adolescent years, corresponding to the time when students enroll in college (Yurchisin & Johnson, 2004). College students are prone to compulsive buying because of their desire to fit in and seek approval of their peers through the acquisition of material goods, often with money they don't have (Wang & Xiao, 2009). To help facilitate their spending, college students use credit cards (Bernthal, Crockett, & Rose, 2005). Eighty-four percent of college students have at least one credit card, and the average student has 4.6 (Sallie Mae, 2009). College students' credit card habits shape their financial future; those with the 'buy now, pay later' philosophy find themselves in debt before they graduate (Yurchisin & Johnson, 2004). In addition, debt of college students mirrors the population as a whole (Woolsey & Schultz, 2010). In 2001, 21 percent of college students with credit cards had $3,000-$7,000 of debt.

Compulsive buying

At its extreme, compulsive buying is a clinical disorder that leads to distress, impaired functioning, and severe financial debt (DSM-IV-TR, American Psychological Association, 2000). It is medically defined as, "A mental disorder characterized by irresistible impulses to engage in harmful or senseless behavior" (Palan et al., 2011, p. 2). Only 6-12 percent of the population fits into this definition. Corresponding to the study by Palan and colleagues, this study focuses on a conceptualized approach to compulsive buying. The field of marketing defines compulsive buying as, "Chronic, repetitive purchasing that becomes a primary response to negative events or feelings" (O'Guinn & Faber, 1989, p.155). Compulsive buying in this approach looks at the behavior on a continuum with recreational and incidental uncontrolled spending at one end, and chronic/addictive on the other (Edwards, 1992). There is a large middle ground between the clinical and the conceptualized definition, and more college students fall under the compulsive buying tendencies when examined on a continuum (Palan et al., 2011).

Self-Esteem

Self-esteem is an individual's sense of worth and how much a person likes, accepts, and respects him or her for who he or she is (Pascarella & Terenzini, 1991). Self-esteem develops during childhood but can be adjusted in college years because self-identity does not form until late teens and early twenties (Erikson, 1950). Self-esteem is proven to be heavily influenced by environment, life experiences, and relationships (Pascarella & Terenzini, 1991). Previous research found a negative correlation between self-esteem and compulsive buying. Black (2007), Christenson et al. (1994), and Kasser and Kanner (2004) all found compulsive buying linked with poorer self-esteem and poor psychological adjustment. Compulsive buying is a way to self-medicate to alleviate a negative mood (Dittmar, Long, & Bond, 2007). Compulsive buyers believe they can fix their low self-esteem and negative feelings through acquisition of material goods. Females have a higher tendency to try to improve their mood and image through buying.

Power Prestige

Power prestige is derived from the Money Attitude Scale by Yamauchi and Templer (1982) as a dimension that represents the use of money to influence and impress others and to symbolize success. Money is instrumental to meet our needs to buy goods and services but can also serve to demonstrate power and status. The current consumer culture is the pursuit of money and material possession in order to gain image, status, and happiness (Dittmar, 2005a). Those with higher levels of power prestige display status goods and participate in conspicuous consumption. Previous research explained perceived identity gains, to impress or gain prestige, is linked as a predictor to compulsive buying (Dittmar, 2005a). Compulsive buyers have a greater perceived association between social status and purchases than non-compulsive buyers (Roberts, 1998). In addition, the study by Palan et al. (2011) found a strong, positive correlation between compulsive buying, credit card misuse, and power prestige.

Risk Taking

Risk taking is the tendency to engage in risky, thrilling, exciting, or adventurous activities (Barlow, 1991). Risk taking is linked with adolescence and early adulthood (Scott, Reppucci, & Woodlard, 1995) and is part of the developmental process (Baumrind, 1987). Individuals feel invulnerable when they take risks that stem from their assessment and attitude of risk (Scott, Reppucci, & Woodlard, 1995). Two types of risk-taking behavior is financial and social risk. Financial risks leads to a monetary gain or loss and social risks leads to embarrassment/esteem or disapproval/approval (Mandel, 2003). For the individuals that are concerned with their membership of a larger social group, preventing social risks are a main focus to prevent embarrassment (Aaker & Lee, 2001). This can lead to impulsivity and a credit card debt among college students (Mansfield, Pinto & Parente, 2003).

Credit Card Misuse

Credit cards make it easier to spend more money than you have and to make impulse purchases you would not likely make if you were spending cash (Dittmar, Long, & Meek, 2004). A study by Feinburg (1986) found college students who are exposed to a credit card logo were more likely to make a purchase in a quicker time and spend more than students not exposed to credit card logos. Because of this, Sallie Mae (2009) revealed that the median student debt began at $939 for college freshmen and $4,100 for graduating seniors. Many college students assert they lack the knowledge of how to manage their credit cards successfully, which can contribute to the accumulated debt (Norvilitis & Santa Maria, 2002). Furthermore, O'Guinn and Faber (1989) found students with more credit cars and higher balances were more likely to be compulsive buyers.

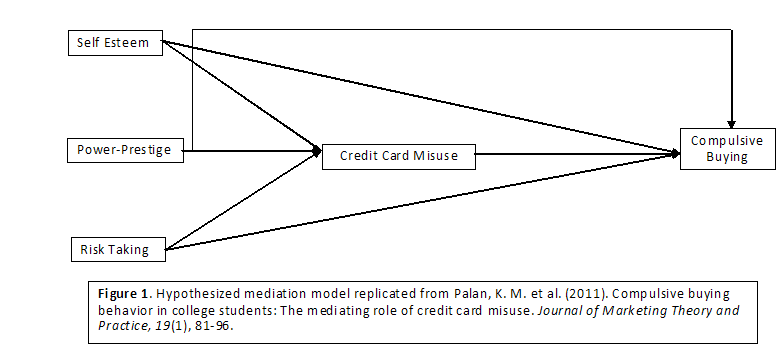

Modified Replication

This study will replicate the study by Palan et al. (2011) who examined credit card use as a mediator between self-esteem, power prestige, and risk taking for compulsive buying in college students (See Figure 1). To add to the current research, this study will use students from Bradley University, including all colleges and years. We will also add to the questionnaire by including a Ten-Item-Personality-Inventory (TIPI) (Gosling et al., 2003). Our hypotheses remain the same as Palan et al.:

1. Self-esteem is negatively related to credit card misuse and compulsive buying.

2. Power prestige is positively related to credit card misuse and compulsive buying.

3. Risk taking is positively related to credit card misuse and compulsive buying.

4. Credit card misuse is positively related to compulsive buying.

Method

Sample and Procedures

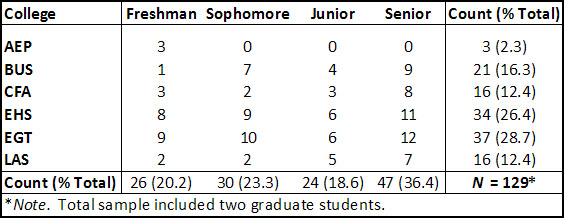

After the university human subjects review and approval, students from Bradley University (N=199) were asked to participate by convenience sample. Unlike the study from Palan et al. (2011) who included only undergraduate senior business majors, all colleges and years were included in the sample. A table was set up in the Michael Student Center on two occasions from 11:00 am - 3:00 pm. The primary investigator asked students to fill out a questionnaire with a $50.00 Visa gift card raffle incentive. Only the questionnaires of participants who had a credit card (N=129) were used in data analysis (See Table 1).

Table 1.

Sample Descriptives

Measures

The questionnaire included prescreening questions, demographics, and 6 variable sections—36 questions total. Questions assessing variables in the model were replicated from Palan et al (2011).

Compulsive Buying. Three questions to measure compulsive buying tendencies came from a scale developed by Faber and O'Guinn (1992). The questions utilized a Likert scale with 1= never to 5= very often. The higher the participant scored, the higher the tendency of compulsive buying behavior. Internal consistency, assessed by Cronbach's alpha, was .62.

Credit Card Misuse. Three questions to measure credit card misuse were selected from the Roberts and Jones (2001) scale. The scale ranged from 1= strongly disagree to 5=strongly agree Likert-type response. Higher scores on this measure indicated poor credit card management. Cronbach's alpha for this scale was .85.

Self-esteem. Three questions from a scale by Rosenburg (1965) were adapted in Palan et al. (2011) and used to measure self-esteem. The Likert-type scale ranged from 1= strongly disagree to 5= strongly agree, with higher responses indicating positive self-esteem. Cronbach's alpha was .79.

Power Prestige. Three questions were chosen from Yamauchi and Templer's (1982) money attitude scale to measure the dimension of power prestige. Likert-type responses were indicated from 1=never to 7= always, with higher responses measuring a stronger need for power prestige. Cronbach's alpha = .75.

Risk Taking. Three questions for risk taking were chosen from a scale developed by Grasmick et al (1993) and adapted by Palan et al (2011). The scale ranged from 1= never to 7= always Likert-type responses with higher responses indicating higher risk-taking behaviors and Cronbach's alpha was .73.

Personality. In addition, a ten-item personality inventory (TIPI) by Gosling et al. (2003) was included to control for personality's affect on the variables. The Likert-type scale ranged from 1= disagree strongly to 7=agree strongly. Higher scores signified identification with the personality trait. Cronbach's alpha for this scale was .61.

Data Analysis

In order to investigate and test the study's research hypotheses regarding relationship between variables, this study required two tests of association (correlation and partial correlation, respectively) using SPSS 19.0. We tested the specified path model using Mplus 7.0 (Muthén & Muthén, 1998-2012).

Results

First, we conducted frequency, descriptive, bivariate, and partial correlation analyses with SPSS 19.0. Also we checked all study variables for univariate normality. (See Table 1)

Hypotheses: Bivariate and Partial Correlations

1. Self-esteem (SE) is negatively related to credit card misuse (CCM) and compulsive buying behavior (CB).

We used the question, "Do you have a credit card?" as a screening document for all analyses assessing credit card misuse. Thus, only those who answered "Yes" were included (n=129); for all other analyses, n = 199. SE correlated with CCM significantly, r = -.17, p = .051 and but not with CB, r = -.08, p =.27.

As a follow-up research question, we conducted partial correlations, controlling for biological sex and personality (TIPI). First, the bivariate relationship between SE and TIPI was significant, r = .31, p < .001; sex was not significantly associated with any of the variables of interest, CCM, or CB, but was associated with TIPI, r = .16, p = .03. Second, when controlling both for sex and TIPI, the significant association between SE and CCM became insignificant, r =-.12, p = .19 and the correlation between SE and CB remained insignificant, r = -.03, p = .70.

2. Higher levels of power prestige (PP) are positively related to higher levels of credit card misuse (CCM) and higher levels of compulsive buying (CB).

PP correlated with CB significantly, r = .32, p < .001; after controlling for sex and TIPI, there was no change in the association or its significance. PP correlated with CCM, r = .36, p < .001, even after controlling for sex and TIPI, r = .34, p < .001. However, TIPI was significantly associated with PP, r = -.27, p < .001, but not CB, r =-.05, p = .52.

3. Higher levels of risk taking (RT) are positively related to higher levels of credit card misuse (CCM) and higher levels of compulsive buying (CB).

RT correlated with CCM significantly, r = .20, p = .03; however, after controlling for sex and TIPI, there was no significant association, r = .14, p = .12. RT correlated with CB, r = .14, p = .055; however, after controlling for sex and TIPI, r = .16, p = .03. However, TIPI was significantly associated with RT, r = .18, p = .04, as was sex, r = -.19, p = .03.

4. Higher levels of credit card misuse (CCM) are positively related to compulsive buying (CB).

CCM correlated with CB significantly, r = .47, p < .001; after controlling for sex and TIPI, there was no change in the association or its significance. Neither TIPI nor sex was associated significantly with CCM or CB.

Hypotheses: Mediation Analyses

1. Credit card misuse mediates the relationship between self-esteem and compulsive buying behavior.

2. Credit card misuse mediates the relationship between power prestige and compulsive buying behavior.

3. Credit card misuse mediates the relationship between risk taking and compulsive buying behavior.

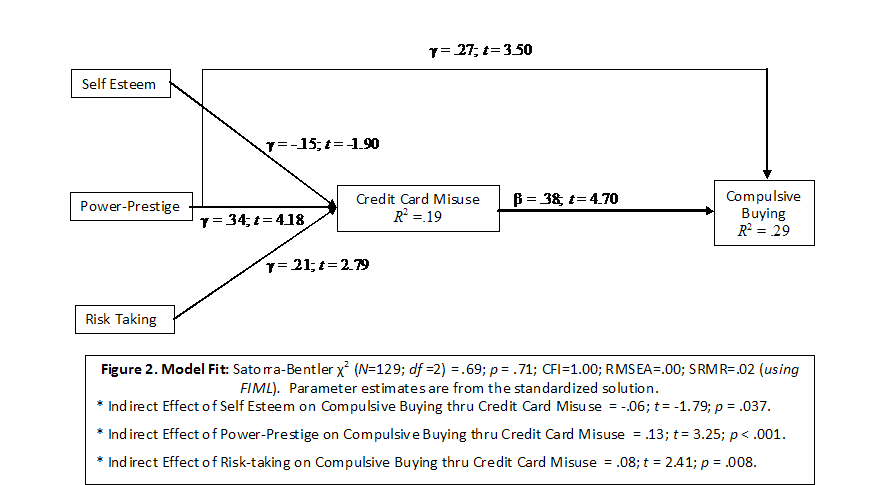

Second, we tested the specified path model using Mplus 7.0 (Muthén & Muthén, 1998-2012), see Figures 1 and 2. Figure 1 is the full model with all possible paths estimated. Two paths were not significant, the direct effect of self-esteem on compulsive buying (γ = .05; t = .65) and the direct effect of risk taking on compulsive buying (γ = .03; t = .44). Thus, based on these results we next tested a model with complete mediation of self-esteem, power-prestige, and risk taking on compulsive buying through credit card misuse.

Last, we conducted two more tests of model fit, finding the model with the direct effect of power-prestige on compulsive buying and the complete mediation of self-esteem and risk taking through credit card misuse to be the best fitting model: Satorra-Bentler χ2 (N=129; df =2) = .69; p = .71; CFI=1.00; RMSEA=.00; SRMR=.02. Three follow-up tests of mediation or indirect effects were conducted (standardized effects reported): (a) the specific indirect effect of self-esteem on compulsive buying through credit card misuse: -.06, t = -1.79, p = .037; one-tailed test; (b) the specific indirect effect of power-prestige on compulsive buying thru credit card misuse: .13; t = 3.25; p < .001; one-tailed test; and (c) the specific indirect effect of risk-taking on compulsive buying thru credit card misuse = .08; t = 2.41; p = .008; one-tailed test. Last, we conducted the same test controlling for sex and TIPI; in this model, the influence of self-esteem was no longer significant on credit card misuse.

Discussion

Our hypothesis, based upon the prior study by Palan et al. (2011), anticipated that credit card misuse would be a mediator between self-esteem, power prestige, and risk taking for compulsive buying behaviors. The results of Palan et al.'s study found only a direct path from power prestige to compulsive buying and a mediating path of power prestige through credit card misuse. The results of our replicated study found credit card misuse was a complete mediator for self-esteem, power prestige, and risk taking and also found a direct path from power prestige to compulsive buying. A reason our study found more hypothesized paths in the model, relative to Palan and colleagues, could be a difference in the samples. Unlike Palan et al. (2011) who used senior, undergraduate business majors, the current study was open to all colleges and years. The present study's broader sample allowed for greater external validity and supplemental analyses explained that college had an effect on the model. Each college attracts different personalities and value sets that will vary in degree on the variables in the model. All colleges were represented in the sample to explain why credit card misuse was found as a complete mediator.

Furthermore, the complete mediation reveals that credit card misuse leading to compulsive buying is a problem university wide, and not limited to a specific year or college. Therefore, credit card misuse is critical to reducing compulsive buying. We propose a financial management class be mandatory for freshman year students, across all colleges in the university. Students can learn about the necessity of developing a positive credit rating and also the dangers of credit card misuse. A financial management class will create awareness and the possibility that students will spend responsibly before student debt becomes unmanageable. A study by Masud, Husniyah, Lially, and Britt (2004) found 90 percent of the 1,500 students sampled needed financial management education. Holub (2002) found students were not prepared for short term credit card misuse effects, such as terms of use penalties and the long term effects of low credit scores that hurt future plans and purchases. These effects can be overwhelming to undergraduate students during school and upon graduation. An administrator from Indiana University stated the university loses more students to credit card and debt problems than academic problems (Commercial Law Bulletin, 1998).

A college level financial class may be effective because of the "Teachable Moment Maxim," which holds that interest in personal finances heightens learning (Peng et al., 2007, p. 16). The increased responsibility of bills, credit cards, savings, and loans to college students fuels their learning process (Kolb, 1984). In addition, the course yields higher success rates when personal involvement and concrete examples are incorporated (Kolb, 1984). Prior research found even a short seminar can have a positive impact on knowledge and attitudes of credit cards (Fox, Bartholomae, & Lee, 2005). Borden, Lee, Serido, & Collins (2008) found one seminar on basic financial skills led to using savings/investments plans, increasing effective financial behavior, and decreasing risky behavior within one year. In addition, we propose future research expand on the current study by increasing the sample size. Samples from universities across the nation would test the validity of the model on a broader scale. Larger sample sizes per college would also allow future researchers to test how specific colleges affect the model. Results from specific colleges can help shape the financial management class to target students' needs.

References

Aaker, J. L., & Lee, J. Y. (2001). 'I' seek pleasures and 'We' avoid pains: The role of self-regulatory goals in information processing and persuasion. Journal of Consumer Research, 28, 33-39.

American Psychiatric Association (2000). Diagnostic and statistical manual for mental disorders, 4th Edition, Text Revision (DSM–IV–TR). Washington, DC: Author.

Barlow, H.D. (1991). Explaining crimes and analogous acts, or the unrestrained will grab at pleasure whenever they can. Journal of Criminal Law and Criminology, 82(2), 229-242.

Baumrind, D. (1987). A development perspective on adolescent risk-taking in contemporary America. New Directions for Child and Adolescent Development, 37, 93-125.

Bernthal, M. J., Crockett, D., & Rose, R. L. (2005). Credit cards as lifestyle facilitators. Journal of Consumer Research, 32(1), 130-145.

Black, D. W. (2007). A review of compulsive buying disorder. World Psychiatry, 6(1), 14-18.

Borden, L. M., Lee, S. A., Serido, J., & Collins, D. (2008). Changing college students' financial knowledge, and behavior through seminar participation. Journal of Family Economic Issues, 29, 23-40.

Christenson, G. A., Faber, R. J., De Zwaan, M., Raymond, N. C., Specker, S. M., Ekern, M. D., Mackenzie, T. B., Crosby, R. D., Crow, S. J., Eckert, E. D., Mussell, M. P., & Mitchell, J. E. (1994). Compulsive buying: Descriptive characteristics and psychiatric comorbidity. Journal of Clinical Psychiatry, 55(1), 5–11.

Commercial Law Bulletin. (1998). Student Credit Card Debt, 13, 7.

Dittmar, H. (2002). The role of self-image in excessive buying. In A.L. Benson (Ed.), I shop, therefore I am: Compulsive buying and the search for self (pp. 105-132). Northvale, NJ: Jason Aronson Inc.

Dittmar, H. (2004b). Understanding and diagnosing compulsive buying. In R. Coombs (Ed.), Addictive disorders: A guide to diagnosis and treatment (pp. 411-450). New York: Wiley.

Dittmar, H. (2005a). A new look at "compulsive buying": Self–discrepancies and materialistic values as predictors of compulsive buying tendency. Journal of Social and Clinical Psychology, 24, 806–833.

Dittmar, H., Long, K.,& Meek, R. (2004). Buying on the Internet: Gender differences in online and conventional buying motivations. Sex Roles, 50, 423–444.

Dittmar, H., Long, K., & Bond, R. (2007). When a better self is only a click away: Associations between materialistic values, emotional and identity-related buying motives, and compulsive buying tendency online. Journal of Social and Clinical Psychology, 26, 334-361.

Edwards, E. A. (1992). The measurement and modeling of compulsive consumer buying behavior. Ph.D. dissertation, University of Michigan.

Erikson, E. H. (1950). Childhood and Society, New York: W. W. Norton.

Faber, R. J., & O'Guinn, T. (1992). A clinical screener for compulsive buying. Journal of Consumer Research, 19(3), 459-469.

Feinberg, R.A. (1986). Credit cards as spending facilitating stimuli: A conditioning interpretation. Journal of Consumer Research, 13(3), 348-356.

Fox, J., Bartholomae, S., & Lee, J. (2005). Building the case for financial education. The Journal of Consumer Affairs, 39, 195–214.

Gosling, S. D., Rentfrow, P. J., Swann, W. B., Jr. (2003). A very brief measure of the big-five personality domains. Journal of Research in Personality, 37, 504-528.

Grasmick, H. G., Tittle, C.R., Bursick, R. J., Jr., & Arneklev, B. J. (1993). Testing the core empirical implications of Gottfredson and Hirschi's general theory of crime. Journal of Research in Crime and Delinquency, 30(1), 5-29.

Holub, T. (2002). Credit card usage and debt among college and university students. (ERIC Document Reproduction Service No. ED466106).

Kasser, T., & Kanner, A. D. (Eds.) (2004). Psychology and consumer culture: The struggle for a good life in a materialistic world. Washington, DC: American Psychological Association.

Kolb, D. (1984). Experiential learning: Experience as the source of learning and development. Englewood Cliffs, NJ: Prentice Hall.

Mandel, N. (2003). Shifting selves and decision making: The effects of self-construal priming on consumer risk-taking," Journal of Consumer Research, 30, 30-40.

Mansfield, P. M., Pinto, M. B., &. Parente, D. H. (2003). Self-control and credit card use among college students. Psychological Reports, 92(3), 1067-1078.

Masud, J., Husniyah, A. R., Laily, P., & Britt, S. (2004). Financial behavior and problems among university students: Need for financial education. Journal of Personal Finance, 3, 82–96.

Muthén, L.K., & Muthén, B. O. (1998-2012). Mplus user's guide (7th ed.). Los Angeles, CA: Muthén & Muthén.

Neuner, M., Raab, R., & Reisch, L. A. (2005). Compulsive buying in maturing consumer societies: An empirical re-inquiry. Journal of Economics Psychiatry, 26, 509-522.

Norvilitis, J. M., & Santa Maria, P. (2002). Credit card debt on college campuses: Causes, consequences, and solutions. College Student Journal, 36, 357-364.

O'Guinn, Thomas C., and Ronald J. Faber (1989), Compulsive Buying: A Phenomenological Exploration. Journal of Consumer Research, 16(2), 147-157.

Peng, T. C. M., Bartholomae, S., Fox, J. J., & Cravener, G. (2007). The impact of personal finance education delivered in high school and college courses. Journal of Family Economic Issues, 28, 265-284.

Palan, K., Morrow, P., Trapp, A., II, & Blackburn, V. (2011). Compulsive buying behavior in college students: The mediating role of credit card misuse. Journal of Marketing Theory and Practice, 19, 81-96.

Pascarella, E. T., & Terenzini, P. (1991). How college affects students: Findings and insights from twenty years of research. San Francisco: Jossey-Bass.

Roberts, J. A. (1998). Compulsive buying among college students: An investigation of its antecedents, consequences, and implications for public policy. Journal of Consumer Affairs, 32(2), 295–319.

Roberts, J. A., & Jones, E. (2001). Money attitudes, credit card use, and compulsive buying among American college students. Journal of Consumer Affairs, 35(2), 213-241.

Rosenberg, M. (1965). Society and the Adolescent Self-Image. Princeton, NJ: Princeton University Press.

Sallie Mae (2009). How Undergraduate Students Use Credit Cards. Wilkes-Barre, PA. Retrieved from

www.salliemae.com/NR/rdonlyres/0BD600F1-9377-46EA-AB1F-6061FC763246/10744/SLMCreditCardUsageStudy41309FINAL2.pdfScott, E. S., Reppucci, N. D., & Woolard, J. L. (1995). Evaluating adolescent decision making in legal contexts. Law and Human Behavior, 19(3), 221-243.

Wang, Jeff, and Xiao, J. J. (2009), Buying behavior, social support and credit card indebtedness of college students. International Journal of Consumer Studies, 33(1), 2-10.

Woolsey, B., & Schultz, M. (2010). Credit card statistics, industry facts, debt statistics. Retrieved from

http://webcache.googleusercontent.com/search?q=cache:rfeJxdTniMcJ:www.credit cards.com...Yamauchi, K. T., & Templer, D. J. (1982). The development of a Money Attitudes Scale, Journal of Personality Assessment, 46 (5), 522-528.

Yurchisin, J., & Johnson, K. K. P. (2004), Compulsive buying behavior and its relationship to perceived social status associated with buying, materialism, self-esteem, and apparel-product involvement. Family and Consumer Sciences Research Journal, 32, 291–314.

|